Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| KAPSTONE PAPER AND PACKAGING CORPORATION | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

March 31, 201528, 2016

Dear Stockholder:

This year's Annual Meeting of Stockholders will be held on Thursday,Wednesday, May 14, 201511, 2016 at 11:00 a.m., Central Daylight Time, at the Renaissance Hotel, 9331033 Skokie Boulevard, Suite 100, Northbrook, Illinois. You are cordially invited to attend.

The Notice of Annual Meeting of Stockholders and a Proxy Statement, which describe the formal business to be conducted at the meeting, follow this letter.

After reading the Proxy Statement, please make sure to vote your shares by promptly dating, signing, and returning the enclosed proxy card or attending the Annual Meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before the Company'sKapStone's stockholders are important.

A copy of the Company's 2014KapStone's 2015 Annual Report is also enclosed.

I look forward to seeing you at the Annual Meeting.

| Very truly yours, | ||

| ||

| Roger W. Stone Chairman and Chief Executive Officer |

This summary contains highlights about our CompanyKapStone Paper and Packaging Corporation (the "Company") and the upcoming 20152016 Annual Meeting of Stockholders. This summary does not contain all of the information that you should consider in advance of the meeting, and we encourage you to read the entire Proxy Statement carefully before voting.

Board of Directors

Stockholder Interests

EXECUTIVE COMPENSATION HIGHLIGHTS

We believe that compensation for executives should be determined according to a competitive framework taking into account the financial performance of the Company, individual contributions and the external market in which the Company competes for executive talent. The Company relies principally on the following elements of compensation:

In 2014,2015, the Compensation Committee utilized the assistance of Frederic W. Cook & Co., an executive compensation consulting company, to assist in evaluating executive compensation programs and in evaluating named executive officers' compensation compared to an established peer group of similar companies.

Best practices associated with our executive compensation programs include:

Agenda Items | Agenda Items | Board Vote Recommendation | Page Reference | Agenda Items | Board Vote Recommendation | Page Reference | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. | Election of four director nominees named in this Proxy Statement, each for a three-year term | FOR each director nominee | 6 | Election of four director nominees named in this Proxy Statement, each for a three-year term | FOR each director nominee | 6 | ||||||||

2. | Vote to ratify appointment of Ernst & Young LLP as independent auditor for 2015 | FOR | 41 | Vote to ratify appointment of Ernst & Young LLP as independent registered public accounting firm for 2016 | FOR | 40 | ||||||||

3. | Advisory vote to approve executive compensation | FOR | 42 | Advisory vote to approve the Company's named executive officer compensation | FOR | 41 | ||||||||

4. | Vote to approve the Company's 2016 Incentive Plan | FOR | 42 | |||||||||||

The following table provides summary information about our nominees for election to the Board of Directors. Additional information for all directors, including nominees, may be found beginning on page 67 of this Proxy Statement.

Name | Director Since | Business Experience | Independent | ||||

|---|---|---|---|---|---|---|---|

Robert Bahash | 2014 | Yes | |||||

| 2013 | President and | Yes | ||||

| 2009 | ||||||

Former Chairman and CEO of | Yes | ||||||

David P. Storch | 2009 | President, Chairman and | |||||

We are asking stockholders to ratify the appointment of Ernst & Young LLP as our independent auditorregistered public accounting firm for 2015.2016. We paid Ernst & Young LLP a total of $3,427,819$4,890,139 in fees in 2014.2015. Additional information regarding our independent auditorregistered public accounting firm and audit fees may be found beginning on page 2221 of this Proxy Statement.

We are asking stockholders to cast an advisory, nonbinding vote to approve the compensation awarded to our Named Executive Officers as disclosed in this Proxy Statement. Additional information regarding our executive compensation may be found beginning on page 2524 of this Proxy Statement.

Vote to Approve the Company's 2016 Incentive Plan (Proposal No. 4)

We are asking stockholders to approve our 2016 Incentive Plan. Additional information regarding this plan may be found beginning on page 42 of this Proxy Statement.

| Date and time | May | |

Place | ||

| Suite 100 Northbrook, Illinois 60062 | ||

Record date | March | |

Voting | Stockholders of record at the close of business on the record date may vote at the Annual Meeting. Each share is entitled to one vote on each matter to be voted upon. |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | ||||

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS | 1 | |||

FREQUENTLY ASKED QUESTIONS | 1 | |||

STOCK OWNERSHIP | 4 | |||

Security Ownership of Management | 4 | |||

Security Ownership of Certain Beneficial Stockholders | ||||

Securities Authorized for Issuance under Equity Compensation | 5 | |||

PROPOSAL 1—ELECTION OF DIRECTORS | 6 | |||

Nominees for Election at the | ||||

GOVERNANCE STRUCTURE | ||||

Role of the Board | ||||

Board Leadership Structure | ||||

Who are the independent directors? | ||||

How often did the Board meet during | ||||

What is the Company's policy regarding director attendance at the Annual Meeting? | ||||

What committees has the Board established? | 14 | |||

How are directors nominated? | ||||

| ||||

Non-Employee Director Outstanding Equity Awards at | 18 | |||

Director Stock Ownership Requirements | 18 | |||

Corporate Governance | 18 | |||

Risk Oversight | 18 | |||

REPORT OF THE AUDIT COMMITTEE | ||||

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||||

Fees of Independent Registered Public Accounting Firm | ||||

EXECUTIVE OFFICERS | ||||

EXECUTIVE COMPENSATION | ||||

Compensation Discussion and Analysis | ||||

Compensation Policies and Objectives | 24 | |||

Elements of Compensation | 25 | |||

No Severance Agreements | 25 | |||

Overview of Compensation Program and Process | ||||

Benchmarking | ||||

Components of Executive Compensation | ||||

Regulatory Considerations | ||||

Named Executive Officer Stock Ownership Requirements | ||||

Report of the Compensation Committee | ||||

Compensation Committee Interlocks and Insider Participation | ||||

| ||||

SUMMARY COMPENSATION TABLE | 33 | |||

2015 GRANTS OF PLAN-BASED AWARDS | 34 | |||

| 35 | |||

| 36 | |||

| 36 | |||

POTENTIAL PAYMENTS UPON CHANGE-IN-CONTROL OR TERMINATION | 37 | |||

| ||||

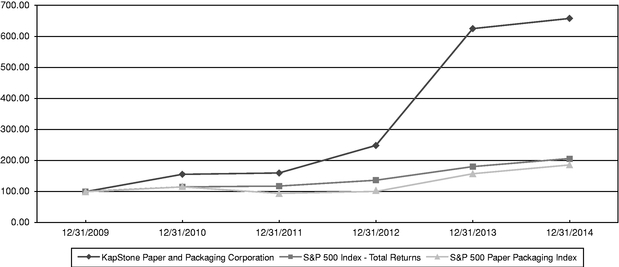

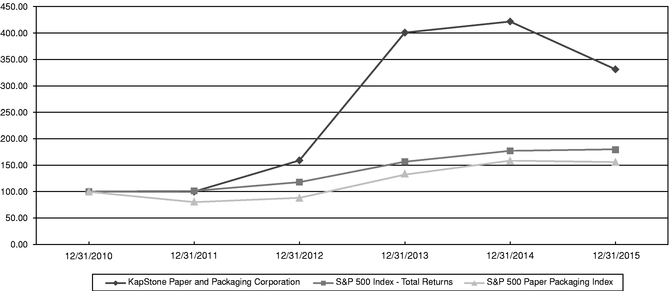

STOCK PRICE PERFORMANCE PRESENTATION | ||||

| ||||

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | ||||

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | ||||

CODE OF ETHICS |

i

PROPOSAL 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||||

PROPOSAL 3—APPROVAL OF THE COMPANY'S EXECUTIVE COMPENSATION | 41 | |||

PROPOSAL 4—APPROVAL OF THE COMPANY'S 2016 INCENTIVE PLAN | 42 | |||

ADDITIONAL INFORMATION | ||||

WHERE YOU CAN FIND MORE INFORMATION | ||||

TRANSACTION OF OTHER BUSINESS | ||||

ANNEX A—KAPSTONE PAPER AND PACKAGING 2016 INCENTIVE PLAN | 51 |

ii

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 14, 201511, 2016

To the Stockholders:

The Annual Meeting of Stockholders of KapStone Paper and Packaging Corporation ("KapStone" or the "Company") will be held on Thursday,Wednesday, May 14, 2015,11, 2016, at 11:00 a.m., Central Daylight Time, at the Renaissance Hotel, 9331033 Skokie Boulevard, Suite 100, Northbrook, Illinois 60062, for the following purposes:

Stockholders of record at the close of business on March 16, 201514, 2016 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. For ten days prior to the Annual Meeting, a complete list of the stockholders of record on March 16, 201514, 2016 will be available at the Company's principal offices for examination during ordinary business hours by any stockholder for any purpose relating to the meeting.

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR"

ALL DIRECTOR NOMINEES, AND "FOR" PROPOSALS 2, 3 AND 3.4.

| By Order of the Board of Directors, | ||

| ||

| Roger W. Stone Chairman and Chief Executive Officer |

Northbrook, Illinois

March 31, 201528, 2016

IMPORTANT: Please promptly fill in, date, sign and return the enclosed proxy card in the accompanying pre-paid envelope to ensure that your shares are represented at the meeting. You may revoke your proxy before it is voted. If you attend the meeting, you may choose to vote in person even if you have previously sent in your proxy card.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders To Be Held on May 14, 201511, 2016

The Company's Proxy Statement for the 20152016 Annual Meeting of Stockholders and the Annual Report to Stockholders for the fiscal year ended December 31, 2014,2015, are available at http://ir.kapstonepaper.com.

KapStone Paper and Packaging Corporation

1101 Skokie Boulevard

Suite 300

Northbrook, Illinois 60062

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

The accompanying proxy is being solicited by the Board of Directors (the "Board") of KapStone Paper and Packaging Corporation (the "Company" or "KapStone") and contains information related to the Annual Meeting of Stockholders to be held on Thursday,Wednesday, May 14, 2015,11, 2016, at 11:00 a.m., Central Daylight Time, or any adjournment or postponement thereof ("Annual Meeting"), for the purposes described in the accompanying Notice of Annual Meeting of Stockholders and in this Proxy Statement. The Annual Meeting will be held at the Renaissance Hotel, 9331033 Skokie Boulevard, Suite 100, Northbrook, Illinois. This Proxy Statement was filed with the Securities and Exchange Commission (the "SEC") and is first being sent or given to stockholders on or about March 31, 2015.28, 2016.

You will be voting on:

How does the Board recommend that I vote on each proposal?

The Company's Board recommends that you vote:

Who is entitled to vote at the meeting?

Holders of record of shares of the Company's common stock, $.0001$0.0001 par value per share ("Common Stock") at the close of business on March 16, 2015,14, 2016, (the "Record Date") will be entitled to vote. As of the close of business on the Record Date, there were 96,256,06996,504,032 shares of Common Stock outstanding and entitled to vote.

How many votes am I entitled to?

You are entitled to one vote for each share of Common Stock that you own.

How do I vote shares held in my name?

You may vote in person at the Annual Meeting or by proxy. If you properly complete and sign the enclosed proxy card, the shares held in your name will be voted as you direct. If you sign and return the proxy card but do not include voting instructions, the shares held in your name will be voted FOR the four director nominees named in this Proxy Statement, FOR the ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm, FOR the approval of the Say-on-Pay resolution, and FOR the approval of the Say-on-Pay resolution.Company's 2016 Incentive Plan.

Can I change my vote after I return my proxy card?

You may change your vote or revoke your proxy at any time before the polls close at the Annual Meeting by taking any of the following actions:

How do I vote my shares held by my broker?

If your shares are held in street name, you must either direct your broker as to how to vote your shares, or obtain a proxy from your broker giving you the right to vote the shares in person at the Annual Meeting.

How many votes must be present to constitute a quorum?

A quorum is the presence at the Annual Meeting in person or by proxy of a majority of the outstanding shares of Common Stock. There needs to be a quorum in order for the Annual Meeting to be held. Broker non-votes and proxies received but marked as abstentions will count for purposes of establishing a quorum. Broker non-votes occur when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power for the particular matter and has not received voting instructions from the beneficial owner.

May my shares be voted if I do not provide my proxy?

If your shares are held in street name, they may be voted on matters that the New York Stock Exchange (the "NYSE") considers "routine" even if you do not instruct your broker how to vote your shares. Accordingly, if you do not instruct your broker how to vote your shares, your broker can vote your shares to approve the appointment of Ernst & Young LLP as the Company's independent registered accounting firm, but your broker cannot vote your shares on the election of directors, or the approval of the Say-on-Pay resolution.resolution, or the Company's 2016 Incentive Plan.

What vote is required to approve each proposal, assuming a quorum is present at the Annual Meeting?

It will depend on each proposal.

How are we soliciting this proxy?

The Company may solicit stockholder proxies by mail, telephone, Internet, or personally through certain of its directors, officers and employees who will receive no extra compensation for their services. The Company will bear all costs of soliciting proxies, including, upon request, reimbursing brokers for the reasonable expenses incurred by them in forwarding proxy materials to the beneficial owners of Common Stock.

Anyone desiring to communicate directly with the Board or the non-management directors, individually or as a group, including the presiding director, may do so by written communication addressed to them at KapStone Paper and Packaging Corporation, 1101 Skokie Boulevard, Suite 300, Northbrook, IL 60062, Attention: Vice President, Secretary, and General Counsel. Relevant communications will be forwarded by the Secretary to the appropriate directors depending on the facts and circumstances outlined in the communication.

Security Ownership of Management

The following table shows the amount of the Company's Common Stock beneficially owned, unless otherwise indicated, by the Company's directors, named executive officers and directors and executive officers as a group as of March 16, 2015.14, 2016. Except as otherwise specified, the named beneficial owner has sole voting and investment power over the shares listed. None of the shares are pledged as security. The total number of shares of Common Stock outstanding as of March 16, 201514, 2016 was 96,256,069.96,504,032.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership of Common Stock(1) | Options Currently Exercisable or Exercisable Within 60 Days | Percentage of Common Stock | Amount and Nature of Beneficial Ownership of Common Stock(1) | Options Currently Exercisable or Exercisable Within 60 Days | Percentage of Common Stock | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Roger W. Stone(2) | 6,211,182 | 361,678 | 6.45 | % | 6,382,875 | 434,646 | 6.61 | % | ||||||||||||

Matthew Kaplan | 3,443,070 | 453,870 | 3.58 | % | 3,540,444 | 526,838 | 3.67 | % | ||||||||||||

Robert J. Bahash | 5,000 | — | * | 25,000 | — | * | ||||||||||||||

John M. Chapman | 776,836 | 120,050 | * | 633,795 | 124,853 | * | ||||||||||||||

Jonathan R. Furer | 1,326,730 | 120,050 | 1.38 | % | 1,333,689 | 124,853 | 1.38 | % | ||||||||||||

David G. Gabriel | 4,000 | — | * | 17,065 | 3,065 | * | ||||||||||||||

Brian R. Gamache | 62,856 | 22,778 | * | 69,815 | 27,581 | * | ||||||||||||||

Ronald J. Gidwitz | 114,420 | 22,778 | * | 121,379 | 27,581 | * | ||||||||||||||

Matthew H. Paull | 40,460 | 16,830 | * | 57,419 | 21,633 | * | ||||||||||||||

Maurice S. Reznik | 3,600 | — | * | 3,600 | — | * | ||||||||||||||

David P. Storch | 53,270 | 22,778 | * | 60,229 | 27,581 | * | ||||||||||||||

Andrea K. Tarbox | 225,151 | 133,674 | * | |||||||||||||||||

Timothy P. Keneally | 153,127 | 79,364 | * | 225,827 | 106,522 | * | ||||||||||||||

Randy J. Nebel | 4,000 | — | * | 23,412 | 16,412 | * | ||||||||||||||

Andrea K. Tarbox | 241,257 | 160,832 | * | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

All directors and executive officers as a group (eighteen individuals) | 12,528,046 | 1,428,669 | 13.02 | % | 12,832,918 | 1,671,578 | 13.30 | % | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Security Ownership of Certain Beneficial Stockholders

The following table shows those persons known to us as of March 16, 201514, 2016 to be the beneficial owners of more than 5% of the Company's Common Stock, with the exception of Roger W. Stone,

whose ownership is included in the Security Ownership of Management table above. In furnishing the information below, we have relied upon filings made by the beneficial owners with the SEC.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership of Common Stock(1) | Percentage of Outstanding Common Stock | |||||

|---|---|---|---|---|---|---|---|

BlackRock, Inc.(1) | 7,769,570 | 8.10 | % | ||||

The Vanguard Group(2) | 5,838,892 | 6.08 | % | ||||

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership of Common Stock(1) | Percentage of Outstanding Common Stock | |||||

|---|---|---|---|---|---|---|---|

Wellington Management Group LLP(1) | 8,534,425 | 8.86 | % | ||||

BlackRock, Inc.(2) | 8,468,259 | 8.80 | % | ||||

The Vanguard Group(3) | 6,547,512 | 6.79 | % | ||||

Securities Authorized for Issuance under Equity Compensation PlansPlan

The following table shows information about the Company's equity compensation plansplan at December 31, 2014.2015.

Plan Category | Number of Shares to be Issued Upon Exercise of Outstanding Options and Restricted Stock Units | Weighted Average Exercise Price of Outstanding Options | Number of Shares Remaining Available for Future Issuance under Equity Compensation Plans | Number of Shares to be Issued Upon Exercise of Outstanding Options and Restricted Stock Units | Weighted Average Exercise Price of Outstanding Options | Number of Shares Remaining Available for Future Issuance under Equity Compensation Plans | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Equity compensation plan approved by stockholders | 3,347,373 | $ | 11.81 | 4,968,630 | (2) | 3,815,909 | (1) | $ | 15.45 | 5,006,526 | (2) | |||||||||

Equity compensation plans not approved by stockholders | — | — | — | — | ��� | — | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Total | 3,347,373 | $ | 11.81 | 4,968,360 | 3,815,909 | $ | 15.45 | 5,006,526 | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

PROPOSAL 1

ELECTION OF DIRECTORS

The Company has a classified Board of Directors currently consisting of four Class A directors (Robert J. Bahash, David G. Gabriel, Brian R. Gamache, and David P. Storch) who have terms expiring at the 2016 Annual Meeting of Stockholders, three Class B directors (John M. Chapman, Matthew Kaplan, and Ronald J. Gidwitz)Gidwitz, and Matthew Kaplan) who have terms expiring at the 2017 Annual Meeting of Stockholders, and four Class C directors (Jonathan R. Furer, Matthew H. Paull, Maurice S. Reznik, and Roger W. Stone) who have terms expiring at the 20152018 Annual Meeting of Stockholders. Directors in a class are elected for a term of three years to succeed the directors in such class whose terms expire at such Annual Meeting, or a shorter term to fill a vacancy in another class of directors.

The nominees for election at the 20152016 Annual Meeting of Stockholders to fill the four Class CA positions on the Board of Directors are Jonathan R. Furer, Matthew H. Paull, Maurice S. Reznik,Robert J. Bahash, David G. Gabriel, Brian R Gamache and Roger W. Stone,David P. Storch, each of whom currently serves on the Board. If elected, the Class CA director nominees will serve three-year terms expiring at the Annual Meeting of Stockholders in 20182019 and until their respective successors are elected and qualified. If a quorum is present and voting at the meeting, the four Class CA director nominees receiving the most votes will be elected Class CA directors. Neither abstentions nor broker non-votes will have any effect upon the outcome of voting with respect to the election of directors.

We believe our Board should be composed of individuals with sophistication and experience in many substantive areas that impact our business. We believe experience, qualifications or skills in the following areas are important: paper industry background; sales; manufacturing; capital markets; finance; accounting; leadership of complex organizations; international operations; and familiarity with board practices of major corporations. We believe that all of our Board members possess the professional and personal qualifications necessary for board service, and have highlighted particularly noteworthy attributes of each Board member in the individual biographies below.

The following information relates to the nominees listed above and to the Company's other directors whose terms of office will extend beyond the 20152016 Annual Meeting of Stockholders. Directors' ages are listed as of December 31, 2014.2015.

Nominees for Election at the 20152016 Annual Meeting of Stockholders

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH NOMINEE NAMED ABOVE.

| Robert J. Bahash (age | A director appointed in July 2014, Mr. Bahash was the President of McGraw-Hill Education from November 2010 until his retirement in June 2012. McGraw-Hill Education at that time was an operating segment of The McGraw-Hill Companies, currently known as McGraw Hill Financial, Inc., which was a global financial information and education company. Prior to that time, he served as Executive Vice President and Chief Financial Officer of the McGraw-Hill Companies for twenty-two years. He previously was a member of the Board of Directors for WMS Industries, Inc. (serving most recently as chair of its Audit Committee and a member of its Compensation Committee). Mr. Bahash is a member of the American Institute of Certified Public Accountants, the Financial Executives Institute, and the New Jersey Society of Certified Public Accountants. He graduated from Mount St. Mary's College (Maryland) with a B.S. in Accounting and received an M.B.A. in finance from New York University. Mr. Bahash's qualifications to serve on the Board include his experience as the Chief Financial Officer of a major public company and his training as a certified public accountant. |

David G. Gabriel (age | A director appointed in May 2013, Mr. Gabriel has held the offices of President and Chief Executive Officer of Sonepar North America, a privately owned distributor of electrical products and related solutions, since September 2009. From May 2003 through August 2009, Mr. Gabriel served as President and Chief Executive Officer of Hagemeyer North America, a distributor of products and services relating to electrical, safety, and industrial products. He previously served as Senior Vice President and General Manager of Tenneco Automotive's North American aftermarket business until 2003. Before joining Tenneco in 1995, Mr. Gabriel spent fifteen years in various operating positions of increasing responsibility with PepsiCo, Inc. and Johnson & Johnson. He also serves on the Board of Directors of the Medical University of South Carolina's Children's Hospital. Mr. Gabriel earned his Bachelor of Science in Packaging Engineering from Michigan State University. Mr. Gabriel's qualifications to serve on the Board include his experience in sales, manufacturing, and leadership of complex organizations, all of which make him an integral part of the Company's |

Brian R. Gamache (age | A director appointed in October 2009, Mr. Gamache served as the Chairman and Chief Executive Officer of WMS Industries, Inc., a leading supplier to the gaming industry, until its merger with Scientific Games International, Inc. in 2013. He served as a member of the Board of Directors of WMS Industries from 2001 until 2013. Mr. Gamache | |

David P. Storch (age | A director appointed in October 2009, Mr. Storch has served as the Chief Executive Officer of AAR Corp., a leading provider of diverse products and value-added services to the worldwide aviation/aerospace industry, since 1996. He has served as AAR's Chairman since 2005, President from 1989 to 2007 and again since 2015, Chief Operating Officer from 1989 to 1996, and Vice President from 1988 to 1989. He serves as Chair of the Executive Committee of AAR. Mr. Storch has served on the Board of Directors of Kemper Corporation, a leading insurance and financial services provider formerly known as Unitrin, Inc., since May 2010. He |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH NOMINEE NAMED ABOVE.

| John M. Chapman (age | A director since the Company's inception, Mr. Chapman is a co-founder and has been a managing member of Arcade Partners LLC, a private equity firm, since November 2003. From January 2004 until December 2011 he was a Managing Director of Washington & Congress Managers, a private equity firm. From March 1990 through December 2003, he was employed by Triumph Capital Group, Inc., a private equity firm, last serving as a Managing Director. Mr. Chapman received a B.A. from Bates College and an M.B.A. from the Tuck School of Business at Dartmouth College. Mr. Chapman's qualifications to serve on the Board include his experience in capital markets, finance and accounting. | |

Ronald J. Gidwitz (age 70) | A director appointed in October 2008, Mr. Gidwitz co-founded GCG Partners, a strategic consulting and equity firm, in 1998 and has since served as a partner at that firm. Since 1974 he has served as a director of Continental Materials Corporation, a corporation that manufactures heating, ventilation, and air conditioning (HVAC) products and construction products. From 1996 to 1998, he was President and Chief Executive Officer of the Unilever HPC Helene Curtis Business Unit. Previously, Mr. Gidwitz served as President, Chief Executive Officer and Director of Helene Curtis, a Fortune 500 consumer products company. Mr. Gidwitz received a B.A. in economics from Brown University. Mr. Gidwitz's qualifications to serve on the Board include his experience in sales, manufacturing, leadership of complex organizations, international operations, and familiarity with board practices of major corporations. |

Matthew Kaplan (age | President, Chief Operating Officer and a director since the Company's inception in 2005, Mr. Kaplan was Manager of Stone-Kaplan Investments, LLC, a private investment company, from July 2004 through December 2007. He was President, Chief Operating Officer and a director of Box USA Holdings, Inc., a corrugated box manufacturer, from July 2000 until the sale of the company in July 2004. Mr. Kaplan began his career at Stone Container Corporation in 1979 and was serving as its Senior Vice President and General Manager of North American Operations when Stone Container Corporation merged with Jefferson Smurfit Corporation in November 1998. He was Vice President / General Manager Container Division with Smurfit-Stone Container Corporation and a director of the company until March 1999. Mr. Kaplan served on the board of directors of Victory Packaging from January 2007 until late 2011. In addition, Mr. Kaplan formerly served on the board of directors of Magnetar Spectrum Fund. He is a director of the American Forest and Paper Association and Pacific Millennium Paper Group Limited. Mr. Kaplan received a B.A. in Economics from the University of Pennsylvania and an M.B.A. from the University of Chicago. Mr. Kaplan is the son-in-law of Roger W. Stone. Mr. Kaplan's qualifications to serve on the Board include his experience in the paper industry, sales, manufacturing, capital markets, leadership of complex organizations, familiarity with board practices of major corporations and his service as an executive officer of the Company. |

Class C

(Term Ends 2018)

| Jonathan R. Furer (age 58) | A director since the Company's inception in 2005, Mr. Furer is a co-founder and has been a managing member of Arcade Partners LLC, a private equity firm, since November 2003. From January 2004 until December 2011 he was a Managing Director of Washington & Congress Managers, a private equity firm. Mr. Furer received a B.B.A. in international business from George Washington University. Mr. Furer's qualifications to serve on the Board include his experience in turnarounds, mergers and acquisitions, capital markets, finance and accounting. |

| A director appointed in | ||

Maurice S. Reznik (age 61) | A director appointed in July 2014, Mr. Reznik is CEO of the Women's Intimate Apparel division in the United States and Great Britain for Delta Galil Industries, Ltd. and President of Delta Galil USA. Delta Galil USA is a segment of Delta Galil Industries, Ltd., a manufacturer and marketer of apparel products. Previously Mr. Reznik held the office of Chief Executive Officer of Maidenform Brands, Inc., a global intimate apparel company, from July 2008 until April 2014. He served as a director of |

| Roger W. Stone (age 80) | Chairman of the Board and Chief Executive Officer since the Company's inception in 2005, Mr. Stone was Manager of Stone-Kaplan Investments, LLC, a private investment company, from July 2004 through December 2007. He was Chairman and Chief Executive Officer of Box USA Holdings, Inc., a corrugated box manufacturer, from July 2000 until the sale of that company in July 2004. Mr. Stone was Chairman, President and Chief Executive Officer of Stone Container Corporation, a multinational paper company primarily producing and selling pulp, paper and packaging products, from March 1987 to November 1998, when Stone Container Corporation merged with Jefferson Smurfit Corporation, at which time he became President and Chief Executive Officer of Smurfit-Stone Container Corporation until March 1999. Mr. Stone is also Chairman of Stone Tan China Acquisition (Hong Kong) Co. Ltd. and Stone Tan China Holding Corporation. He is a former director of Smurfit-Stone Container Corporation; Morton International, Inc.; Morton Thiokol, Inc.; and Autoliv, Inc. Mr. Stone served on the board of directors of McDonald's Corporation from 1989 to 2015. Mr. Stone received a B.S. in Economics from the Wharton School at the University of Pennsylvania. Mr. Stone is the father-in-law of Matthew Kaplan. Mr. Stone's qualifications to serve on the Board include his experience in the paper industry, sales, manufacturing, capital markets, finance, leadership of complex organizations, international operations, and familiarity with board practices of major |

The Board is the ultimate decision-making body of the Company, except with respect to matters reserved to stockholders. The primary function of the Board is oversight. The Board, in exercising its business judgment, acts as an advisor and counselor to senior management and defines and enforces standards of accountability—all with a view to enabling senior management to execute their responsibilities fully and in the interests of stockholders. The following are the Board's primary responsibilities, some of which may be carried out by one or more Committees of the Board or the independent directors as appropriate:

In performing its oversight function, the Board is entitled to rely on the advice, reports and opinions of management, counsel, auditors and outside experts. In that regard, the Board and its Committees shall be entitled, at the expense of the Company, to engage such independent legal, financial or other advisors as they deem appropriate, without consulting or obtaining the approval of any officer of the Company.

Our Bylaws require that our Chairman shall be a member of the Board of Directors and may or may not be an officer or employee of the Company. The principal duty of the Company's Chairman is to lead and oversee the Board. The Chairman should facilitate an open flow of information between management and the Board, and should lead a critical evaluation of Company management, practices and adherence to the Company's strategic plan and objectives.

The Company's business is conducted by its employees, managers and officers, under the direction of senior management and led by the CEO. In carrying out the Company's business, the CEO and senior management are accountable to the Board and ultimately to stockholders. Management's primary responsibilities include the day-to-day operation of the Company's business, strategic planning, budgeting, financial reporting, and risk management.

Roger W. Stone is the Company's Chairman of the Board and Chief Executive Officer. The Board believes that Mr. Stone's holding of both positions is in the best interests of the Company due to his vast experience in and knowledge of the paper industry. In addition, the Board believes that having the same person serve as Chairman of the Board and Chief Executive Officer facilitates information flow between management and the Board and helps to assure that the Company speaks with one voice. Mr. Stone's biography can be found on page 812 of this Proxy Statement.

The Board does not have a lead independent director. However, Brian R. Gamache, one of our independent directors, is the presiding director at each executive session of the Board's independent directors. Furthermore, each of our Board committees consists entirely of independent directors.

Who are the independent directors?

Our Corporate Governance Guidelines require that all directors except the Chief Executive Officer and President be independent. An independent director is one who is free of any relationship with the Company or its management that may impair, or appear to impair, the director's ability to make independent judgments, and who meets the NYSE's definition of independence. All members of the Audit, Compensation, and Nominating and Governance Committees shall be independent. The Board determines the independence of each director in accordance with the NYSE listing standards and the Corporate Governance Guidelines on an annual basis. The Board has determined that Robert J. Bahash, John M. Chapman, Jonathan R. Furer, David G. Gabriel, Brian R. Gamache, Ronald J. Gidwitz, Matthew H. Paull, Maurice S. Reznik, and David P. Storch are "independent" directors as that term is defined in the NYSE listing standards and the Corporate Governance Guidelines. In making this determination with respect to Mr. Gabriel, the Board considered, among other things, that (i) he is the President and CEO of Sonepar North America, a company with which the Company engages in ordinary course business transactions, including sales to Sonepar of corrugated containers and purchase from Sonepar of industrial, safety, and electrical materials. The Board had also determinedmaterials and (ii) that Jay Stewart washis son is employed by the Company as an independent director before his resignation from the Board effective May 14, 2014.account representative.

How often did the Board meet during 2014?2015?

Directors are expected to attend all Board meetings and meetings of the Committees on which they serve. During the year ended December 31, 2014,2015, the Board held fiveseven meetings. Each director serving on the Board in 20142015 attended at least 80% of the aggregate total number of Board meetings and Board committee meetings of which he was a member and eligible to attend.attend, with the exception of Mr. Stone who missed two Board meetings while he was on medical leave of absence. The Board's independent directors meet in executive session, without any members of management present, at each regularly scheduled meeting of the Board. Brian R. Gamache is the presiding director at the executive sessions.

What is the Company's policy regarding director attendance at the Annual Meeting?

Members of the Board are strongly encouraged to attend the Company's Annual Meeting of stockholders. All of the directors who were then serving on the Board attended the 20142015 Annual Meeting of Stockholders.

What committees has the Board established?

�� The Board has established three standing committees: Audit, Compensation, and Nominating and Governance. All of the members of the Committees are independent in accordance with applicable SEC regulations, the NYSE listing standards and the Company's Corporate Governance Guidelines.

Committee charters are available on the Governance tab of the Company's website at http://governance.kapstonepaper.com. Each Committee performs its own annual self-assessment.

| | Audit | Compensation | Nominating and Governance | |||

|---|---|---|---|---|---|---|

Robert J. Bahash | ü | |||||

John M. Chapman | ü | ü | ||||

Jonathan R. Furer | * | ü | ||||

David G. Gabriel | ü | |||||

Brian R. Gamache | ü | * | ||||

Ronald J. Gidwitz | ü | ü | ||||

Matthew Kaplan | ||||||

Matthew H. Paull | * | ü | ||||

Maurice S. Reznik | ü | |||||

Roger W. Stone | ||||||

David P. Storch | ü | ü |

Audit Committee. The Audit Committee's function is to review, with the Company's independent registered public accounting firm and management, the annual financial statements and independent registered public accounting firm's opinion, review and maintain direct oversight of the plan, scope and results of the audit by the independent registered public accounting firm, review and approve all professional services performed and related fees charged by the independent registered public accounting firm, be solely responsible for the retention or replacement of the independent registered public accounting firm, and monitor the adequacy of the Company's accounting and financial policies, controls, and reporting systems. In addition, the Audit Committee is responsible for risk oversight of the Company and provides risk assessment reports to the Board. None of the members serve on more than three public company audit committees. All of the members are "financially literate" under the NYSE listing standards, and the Board has determined that Mr. Paull is an "audit committee financial expert" within the meaning of relevant SEC regulations. The Audit Committee held nine meetings in 2014.2015.

Compensation Committee. The functions of the Compensation Committee include providing guidance to management and assisting the Board in matters relating to the compensation of the Chief Executive Officer and executive officers, the Company's compensation and benefits programs, the Company's succession, retention and training programs, and such other matters that have a direct impact on the success of the Company's human resources. The details of the process and procedures followed by the Compensation Committee are disclosed in this Proxy Statement under the headings "Compensation Discussion and Analysis" and "Report of the Compensation Committee." The Compensation Committee held three meetings in 2014.2015.

Nominating and Governance Committee. The Nominating and Governance Committee performs the following functions: assists the Board by identifying prospective director nominees and recommends to the Board the nominees for the annual meeting of stockholders; oversees the Board's annual performance evaluation process; evaluates the composition, organization and governance of the Board

and its committees; and oversees the Company's Corporate Governance Guidelines. In addition, if any incumbent director fails to receive the required vote for re-election, the Nominating and Governance Committee is responsible for making a recommendation to the Board about whether to accept the director's resignation. The Nominating and Governance Committee held four meetings in 2014.2015.

The Nominating and Governance Committee is responsible for selecting candidates for Board membership, subject to Board approval, and for extending invitations to join the Board. In selecting candidates, the Board endeavors to find individuals of high integrity who have a solid record of accomplishment in their chosen fields and who display the independence of mind and strength of character to effectively represent the best interests of the stockholders. Candidates are selected for their ability to exercise good judgment, and to provide practical insights. Consistent with its charter, the Nominating and Governance Committee is responsible for screening candidates, establishing criteria for nominees, and for recommending to the Board a slate of candidates for election to the Board at the Annual Meeting of Stockholders. In performing these tasks, the Nominating and Governance Committee has the sole authority to retain and terminate any search firm to be used to identify candidates. Candidates are approved by the full Board. Robert J. Bahash and Maurice S. Reznik were each appointed to the Board on July 24, 2014 upon the recommendation of the Nominating and Governance Committee. Mr. Bahash received a recommendation from Messrs. Gamache and Paull, and Mr. Reznik received a recommendation from Messrs. Stone and Kaplan.

All directors except the Chief Executive Officer and the President are required to be independent. An independent director is one who is free of any relationship with the Company or its management that may impair, or appear to impair, the director's ability to make independent judgments, and who meets the NYSE's definition of independence.

We do not have a specific diversity policy for our Board, however, we consider diversity to be a critical factor in evaluating the composition of the Board, and that for this purpose diversity includes perspectives, experience, differences and viewpoints, as well as race, ethnicity and gender. The Company values diversity and has women and/or minorities serving in several key positions including Chief Financial Officer, Treasurer,Officer; Vice President, Secretary, and General Counsel; and Vice President of Containerboard and Kraft Paper Sales and Marketing.

The Nominating and Governance Committee will consider director candidates recommended by stockholders on the same basis as it considers director candidates identified by the Committee. A stockholder who wishes to recommend a prospective nominee to the Board for consideration by the Nominating and Governance Committee must send a written notice to the company's Vice President, Secretary, and General Counsel at the principal offices of the Company. Such notice must be delivered to our offices by the deadline relating to stockholder nominations as set forth in Article II, Section 4 of the Company's Bylaws and as described in this Proxy Statement under the heading "Additional Information."

Each notice delivered by a stockholder who wishes to recommend a prospective nominee to the Board for consideration by the Nominating and Governance Committee must include the same information about the recommended nominee that would be required by the Company's Bylaws were the stockholder actually nominating such individual for election, including the following information:

A full description of the information that must be provided as to a prospective nominee is set forth in Article II, Section 4 of the Company's Bylaws, which are available on the Governance tab of the Company's website at http://governance.kapstonepaper.com. The Nominating and Governance Committee may require any prospective nominee to furnish such other information as the Committee may reasonably require to determine the qualifications of such nominee to serve as a director of the Company.

20142015 Director Compensation

The Nominating and Governance Committee recommends to the Board the form and amount of compensation for non-employee directors. Only non-employee directors are paid for their service on the Board. Each non-employee director of the Company received the following compensation for service as a director in 2014:2015:

The following table provides information regarding the compensation of the non-employee directors for 2014.2015.

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($)(3) | All Other Compensation ($)(4) | Total ($) | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($)(3) | All Other Compensation ($)(4) | Total ($) | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Robert J. Bahash | $ | 37,500 | $ | 17,714 | $ | 17,708 | $ | 0 | $ | 72,922 | $ | 75,000 | $ | 42,497 | $ | 42,509 | $ | — | $ | 160,006 | ||||||||||||

John M. Chapman | $ | 75,500 | $ | 42,513 | $ | 42,496 | $ | 3,010 | $ | 163,519 | $ | 75,000 | $ | 42,497 | $ | 42,509 | $ | 2,882 | $ | 162,888 | ||||||||||||

Jonathan R. Furer | $ | 85,250 | $ | 42,513 | $ | 42,496 | $ | 3,010 | $ | 173,269 | $ | 90,000 | $ | 42,497 | $ | 42,509 | $ | 2,882 | $ | 177,888 | ||||||||||||

David G. Gabriel | $ | 71,000 | $ | 42,513 | $ | 42,496 | $ | 0 | $ | 156,009 | $ | 75,000 | $ | 42,497 | $ | 42,509 | $ | — | $ | 160,006 | ||||||||||||

Brian R. Gamache | $ | 83,000 | $ | 42,513 | $ | 42,496 | $ | 3,010 | $ | 171,019 | $ | 85,000 | $ | 42,497 | $ | 42,509 | $ | 2,882 | $ | 172,888 | ||||||||||||

Ronald J. Gidwitz | $ | 72,500 | $ | 42,513 | $ | 42,496 | $ | 3,010 | $ | 160,519 | $ | 75,000 | $ | 42,497 | $ | 42,509 | $ | 2,882 | $ | 162,888 | ||||||||||||

Matthew H. Paull | $ | 83,375 | $ | 42,513 | $ | 42,496 | $ | 3,010 | $ | 171,394 | $ | 90,000 | $ | 42,497 | $ | 42,509 | $ | 2,882 | $ | 177,888 | ||||||||||||

Maurice S. Reznik | $ | 37,500 | $ | 17,714 | $ | 17,708 | $ | 0 | $ | 72,922 | $ | 75,000 | $ | 42,497 | $ | 42,509 | $ | — | $ | 160,006 | ||||||||||||

S. Jay Stewart(5) | $ | 33,000 | $ | 42,513 | $ | 42,496 | $ | 3,010 | $ | 121,019 | ||||||||||||||||||||||

David P. Storch | $ | 72,500 | $ | 42,513 | $ | 42,496 | $ | 3,010 | $ | 160,519 | $ | 75,000 | $ | 42,497 | $ | 42,509 | $ | 2,882 | $ | 162,888 | ||||||||||||

Non-Employee Director Outstanding Equity Awards at 2014 Fiscal Year EndDecember 31, 2015

Name | Options(1) | Restricted Stock Units(1) | |||||

|---|---|---|---|---|---|---|---|

Robert J. Bahash | 1,574 | 572 | |||||

John M. Chapman | 126,902 | 6,174 | |||||

Jonathan R. Furer | 126,902 | 6,174 | |||||

David G. Gabriel | 6,130 | 2,080 | |||||

Brian R. Gamache | 29,630 | 6,174 | |||||

Ronald J. Gidwitz | 29,630 | 6,174 | |||||

Matthew Kaplan | 554,562 | 97,356 | |||||

Matthew H. Paull | 23,682 | 6,174 | |||||

Maurice S. Reznik | 1,574 | 572 | |||||

S. Jay Stewart | 126,902 | — | |||||

David P. Storch | 29,630 | 6,174 | |||||

Roger W. Stone | 462,370 | 97,356 | |||||

Name | Options | Restricted Stock Units | |||||

|---|---|---|---|---|---|---|---|

Robert J. Bahash | 5,790 | 1,905 | |||||

John M. Chapman | 131,118 | 4,887 | |||||

Jonathan R. Furer | 131,118 | 4,887 | |||||

David G. Gabriel | 10,346 | 3,413 | |||||

Brian R. Gamache | 33,846 | 4,887 | |||||

Ronald J. Gidwitz | 33,846 | 4,887 | |||||

Matthew H. Paull | 27,898 | 4,887 | |||||

Maurice S. Reznik | 5,790 | 1,905 | |||||

David P. Storch | 33,846 | 4,887 | |||||

Director Stock Ownership Requirements

The Board has created stock ownership requirements to further align the interests of our non-employee directors with those of the Company's stockholders and encourage long-term stockholder value by requiring our non-employee directors to hold a significant equity stake in the Company. On March 13, 2014, our Board increased the stock ownership requirements applicable to our non-employee directors from three times the annual Board cash retainer to five times the annual Board cash retainer. Restricted stock unit awards and vested stock options count toward the ownership requirements. Under the policy, newly appointed or elected directors have four (4) years from joining the Board to comply with these requirements. The Board may, in its discretion, make exceptions to the stock ownership requirements in periods of volatile markets. As of the record date, all directors met the applicable ownership threshold except for Messrs. Bahash, Gabriel, and Reznik. Mr. Gabriel joined the Board on May 16, 2013 and has until May 16, 2017 to meet the ownership threshold, while Messrs. Bahash and Reznik, who joined the Board on July 24, 2014 and havehas until July 24, 2018 to meet them.the ownership threshold.

The following corporate governance materials are available on the Governance tab of the Company's website at http://governance.kapstonepaper.com: (1) Corporate Governance Guidelines; (2) Code of Conduct and Ethics; and (3) the Charterscharters of our Audit, Compensation, and Nominating and Governance Committees. We will provide a copy of these documents to our stockholders, without charge, upon written request addressed to the Company at 1101 Skokie Blvd.,Boulevard, Suite 300, Northbrook, IL 60062, Attention: Vice President, Secretary, and General Counsel.

The Board's involvement in risk oversight involves both the Audit Committee and the full Board. Risk oversight is a standing agenda item at each Audit Committee meeting. The Committee receives reports from the Company's Vice President, Internal Audit as well as from the independent registered public accounting firm at each Audit Committee meeting. The Company's Vice President and Chief Financial Officer as well as its Vice President and Corporate Controller both provide reports to the Audit Committee regarding risk factors, including, but not limited to, treasury risks pertaining to credit, debt, and interest rates as well as financial and accounting risks. The General Counsel keeps the Audit

Committee abreast of issues pertaining to litigation, regulatory matters, and compliance. The Chairman of the Audit Committee reports on the activities of the Committee regarding risk at each meeting of the full Board. Other committees of our Board may also practice risk oversight related directly to such committees' responsibilities. In addition, each regularly scheduled meeting of the Board includes a report from the Company's Chief Executive Officer, Chief Operating Officer, and its Vice PresidentsPresident and General ManagersManager of the Mill and Container Divisions regarding operating risks at each facility, and risks affecting the industry as a whole.

The purpose of the Audit Committee is to assist the Board in its general oversight of KapStone's financial reporting, internal controls, risk and audit functions. The Audit Committee is comprised entirely of independent directors and met nine times during the year.

As described in the Audit Committee Charter, the Committee has oversight responsibilities to stockholders, potential stockholders, the investment community, and other stakeholders related to the:

The Audit Committee charter is available on KapStone's website at http://governance.kapstonepaper.com and was last amended in 2014.

The Audit Committee has reviewed and discussed the consolidated financial statements with management and Ernst & Young LLP, the Company's independent registered public accounting firm. Management is responsible for the preparation, presentation and integrity of KapStone's financial statements; accounting and financial reporting principles; establishing and maintaining disclosure controls and procedures (as defined in the Securities Exchange Act of 1934 as amended (the "Exchange Act") Rule 13a-15(e)); establishing and maintaining internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)); evaluating the effectiveness of disclosure controls and procedures; evaluating the effectiveness of internal control over financial reporting; and evaluating any change in internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, internal control over financial reporting. Ernst & Young LLP is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States of America, as well as expressing an opinion on the effectiveness of internal control over financial reporting.

The Audit Committee provided oversight and advice to management relating to management's assessment of the adequacy of KapStone's internal control over financial reporting in accordance with the requirements of the Sarbanes Oxley Act of 2002. The Audit Committee held private sessions with Ernst & Young LLP to discuss the annual audit. At the conclusion of the process, the Audit Committee reviewed a report from management on the effectiveness of the Company's internal control over financial reporting. The Committee also reviewed the report of management contained in the Company's Annual Report on Form 10-K for the year ended December 31, 2014,2015, filed with the SEC on February 27, 2015,26, 2016, as well as Ernst & Young LLP's Report of Independent Registered Public Accounting Firm included in the Company's Annual Report on Form 10-K related to its audit of (i) the consolidated financial statements and (ii) the effectiveness of internal control over financial reporting.

The Audit Committee has discussed with Ernst & Young LLP the matters required to be discussed under Auditing Standard No. 16 (Communications with Audit Committees) as amended and as adopted by the Public Company Accounting Oversight Board (the "PCAOB"). In addition, the Audit Committee has received from Ernst & Young LLP the written disclosures and the letter regarding the

auditors' communications with the Audit Committee concerning independence required by applicable requirements of the PCAOB, and has discussed with Ernst & Young LLP its independence. In addressing the quality of management's accounting judgments, the Audit Committee asked for management's representations and reviewed certifications prepared by the Chief Executive Officer and

Chief Financial Officer that the audited consolidated financial statements of the Company fairly present, in all material respects, the financial condition and results of operations of the Company. Based on the review of the consolidated financial statements and discussions with and representations from management and Ernst & Young LLP referred to above, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in KapStone's Annual Report on Form 10-K for the year ended December 31, 2014,2015, for filing with the SEC.

The Audit Committee is responsible for the appointment, compensation and oversight of the independent registered public accounting firm. Ernst & Young LLP has been the Company's independent registered public accounting firm since 2006. The Audit Committee and the Board believe that, due to Ernst & Young LLP's knowledge of the Company and of the industry in which the Company operates, it is in the best interests of the Company and its stockholders to continue retention of Ernst & Young LLP to serve as the Company's independent registered public accounting firm.

In accordance with Audit Committee policy and the requirements of law, the Audit Committee pre-approves all non-audit services to be provided by Ernst & Young LLP. In addition, the Audit Committee pre-approves all audit and audit related services provided by Ernst & Young LLP. A further discussion of the fees paid to Ernst & Young LLP for audit and non-audit expenses is included below under the heading "Independent Registered Public Accounting Firm."

AUDIT COMMITTEE |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Fees of Independent Registered Public Accounting Firm

Ernst & Young LLP has acted as the independent registered public accounting firm for the Company since 2006. During such period Ernst & Young LLP also has provided certain audit-related and permitted non-audit services. The Audit Committee's policy is to approve all audit, audit-related, tax and permitted non-audit services performed by Ernst & Young LLP for the Company in accordance with Section 10A(i) of the Exchange Act, and the SEC's rules adopted thereunder. In 20142015 and 2013,2014, the Audit Committee approved in advance all engagements by Ernst & Young LLP on a specific project-by-project basis, including audit, audit-related, tax and permitted non-audit services. No services were rendered by Ernst & Young LLP to the Company in 20142015 or 20132014 pursuant to Rule 2-01(c)(7)(i)(C) of Regulation S-X.

Ernst & Young LLP's fees for services provided for the years ended December 31, 2014,2015, and 2013,2014, respectively, are as follows:

| | 2014 | 2013 | 2015 | 2014 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Type of Fees | ||||||||||||||

Audit fees(1) | $ | 2,894,383 | $ | 2,712,000 | $ | 4,182,428 | $ | 2,894,383 | ||||||

Audit-related fees(2) | — | $ | 390,504 | |||||||||||

Audit related fees(2) | $ | 452,011 | — | |||||||||||

Tax fees(3) | $ | 533,436 | $ | 337,850 | $ | 255,700 | $ | 533,436 | ||||||

All other fees | — | — | — | — | ||||||||||

| | | | | | | | | | | | | | | |

| $ | 3,427,819 | $ | 3,440,354 | $ | 4,890,139 | $ | 3,427,819 | |||||||

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

The following list sets forth the names of our current executive officers, their ages, and their positions as of December 31, 2014.2015. An asterisk denotes that the person is a Named Executive Officer, as designated by the Board.

Name | Age | Position | |||

|---|---|---|---|---|---|

Roger W. Stone* | Chairman and Chief Executive Officer | ||||

Matthew Kaplan* | President and Chief Operating Officer | ||||

Andrea K. Tarbox* | Vice President and Chief Financial Officer | ||||

Timothy P. Keneally* | Vice President and General Manager and President of the Container Division | ||||

Randy J. Nebel* | Vice President and General Manager and President of the Mill Division | ||||

Antionette Meyers | Vice President—Containerboard and Kraft Paper Sales and Marketing | ||||

Michael J. Murphy | Vice President—Finance | ||||

| Vice President, Secretary, and General Counsel | ||||

Mark A. Niehus | Vice President and Corporate Controller | ||||

Biographical information regarding Messrs. Stone and Kaplan is under the heading"Proposal 1— "Proposal 1—Election of Directors."

Andrea K. Tarbox was appointed as our Vice President and Chief Financial Officer in January 2007, prior to which she served as a financial consultant to the Company. From March 2003 through March 2006, Ms. Tarbox served as Chief Financial and Administrative Officer for Uniscribe Professional Services, Inc. Previously, Ms. Tarbox assumed financial positions of increasing responsibility at Gartner Inc., British Petroleum, p.l.c. and Fortune Brands, Inc. Ms. Tarbox began her career with Ernst & Young LLP and is a Certified Public Accountant.

Timothy P. Keneally has been Vice President and General Manager of the Company since January 2007, and was appointed President of the Company's Container Division in August 2013. Previously, Mr. Keneally served as President of the Company's Mill Division from 2007 to 2013. He served as Vice President of Industrial Packaging of International Paper Co. from 2000 to 2006. Before that, Mr. Keneally worked in positions of increasing responsibility at International Paper Co. and Union Camp Corp. Mr. Keneally is on the board of directors of the Fibre Box Association, and has 4344 years of experience in the paper and packaging industry.

Randy J. Nebel has been Vice President and General Manager of the Company and President of the Company's Mill Division since August 2013. Previously, Mr. Nebel served as President of Longview Fibre Paper and Packaging, Inc., a producer of unbleached kraft paper products and corrugated products, from 2008 to 2013 and as its Vice President of Mill Operations and Chief Operating Officer from 2008 to 2009. From 1997 to 2007 he served in various roles at Weyerhaeuser Co., including Vice President and Mill Manager. Before that, Mr. Nebel worked at positions of increasing responsibility at Crown-Zellerbach Corp., James River Co., and Georgia-Pacific Corp. He is on the board of directors of the National Association of Manufacturers.

Antionette Meyers was appointed Vice President—Containerboard and Kraft Paper Sales and Marketing of the Company in September 2013. Previously, she served as Vice President, Domestic Kraft Paper and Linerboard Sales and Marketing, and as Vice President—Mills Sales and Customer Service. She previously worked in positions of increasing responsibility at Champion International Ltd. and International Paper Co. until the Company's acquisition of its kraft papers business.

Michael J. Murphy was appointed as Vice President—Finance in October 2014. Previously, Mr. Murphy served as Vice President and Treasurer of Boise, Inc., a manufacturer of packaging and paper products, until its sale to Packaging Corporation of America in October 2013. He spent over

15 years in investment banking at J.P. Morgan Securities LLC covering the basic materials industry, including packaging companies. He is a Certified Public Accountant.

Timothy P. DavissonKathryn D. Ingraham has beenwas appointed as Vice President, Secretary and General Counsel of the Company since 2008, and Secretary since 2012. Hein May 2015. Previously, Ms. Ingraham served as DirectorDeputy General Counsel of LegalDover Corporation from 2011 to 2015. Prior thereto, she was Deputy General Counsel of Aon Hewitt (f/k/a Hewitt Associates Inc.) and a partner at Altivity Packaging LLC from 2006 to 2008 until its merger with Graphic Packaging Corp. Before that, Mr. Davisson worked for eighteen years in positions of increasing responsibility at Stone Container Corp. and its successor, Smurfit-Stone Container Corp.Dentons (f/k/a Sonnenschein Nath & Rosenthal LLP).

Mark A. Niehus has been Corporate Controller of the Company since 2007, and Vice President since 2010. Before joining the Company, Mr. Niehus held a variety of senior financial management positions at Abbott Laboratories, R.R. Donnelley & Sons, and Midway Games. He is a Certified Public Accountant.

Compensation Discussion and Analysis

In this section, we describe the compensation of our Named Executive Officers. Our Named Executive Officers for 20142015 were the following individuals: Roger W. Stone, the Company's Chief Executive Officer; Matthew Kaplan, the Company's President and Chief Operating Officer; Timothy P. Keneally, the Company's Vice President and General Manager and President of the Company's Container Division; Randy J. Nebel, the Company's Vice President and General Manager and President of the Company's Mill Division; and Andrea K. Tarbox, the Company's Vice President and Chief Financial Officer.

Name | Position | |

|---|---|---|

| Roger W. Stone | Chairman and Chief Executive Officer | |

| Matthew Kaplan | President and Chief Operating Officer | |

| Andrea K. Tarbox | Vice President and Chief Financial Officer | |

| Timothy P. Keneally | Vice President and General Manager and President of the Container Division | |

| Randy J. Nebel | Vice President and General Manager and President of the Mill Division |

Our compensation programs for our Named Executive Officers are administered by the Compensation Committee (the "Committee"), which is composed solely of independent directors as defined in the NYSE listing standards. The Committee operates under a written charter adopted by the Board. The Committee has reviewed and approved the following discussion and analysis, which analyzes the objectives and results for 20142015 of the Company's compensation policies and procedures for its five Named Executive Officers. The Company's compensation programs have been adopted in order to implement the Committee's compensation philosophy, while taking into account the Company's financial performance. The Committee periodically reviews the Company's compensation programs and practices in light of the Committee's compensation philosophy, changes in laws and regulations, and the Company's financial goals.

Compensation Policies and Objectives

The Committee believes that compensation for Named Executive Officers should be determined according to a competitive framework, taking into account the financial performance of the Company, individual contributions and the external market in which the Company competes for executive talent. In determining the compensation of the Company's Named Executive Officers, the Committee seeks to achieve the following objectives through a combination of fixed and variable compensation.

A total compensation package should be competitive. For Named Executive Officers, including the Company's Chief Executive Officer, the Committee considers the level of compensation paid to individuals in comparable executive positions in the Company's peer group in order to recruit and retain executive talent.

Our compensation practices are designed to create a direct link between the aggregate compensation paid to each Named Executive Officer and the financial performance of the Company. In order to accomplish this, the Committee considers the individual performance of each Named Executive Officer by reviewing, among other factors, the achievement of pre-established corporate objectives as well as the recommendations of the Chief Executive Officer. The amount of each component of a Named Executive Officer's compensation is based in part on the Committee's assessment of that individual's performance as well as the other factors discussed in this section.

Our compensation practices are also designed to link a portion of each Named Executive Officer's compensation opportunity directly to the value of the Company's Common Stock through the use of stock-based awards.

To accomplish its compensation objectives and philosophy, the Committee relies on the following elements of compensation, each of which is discussed in more detail below:

When approving the compensation of the Company's Named Executive Officers, the Committee reviews all of the elements of the Company's executive compensation program. Each component of executive compensation is designed for a specific purpose. For example, salaries are a significant component of cash-based annual compensation. Salaries are set to compensate each executive based on that executive's employment and salary history and position within the Company and comparable competitive salaries at companies included in our peer group and the survey data. With regard to the variable components of the compensation package, annual performance-based cash awards are tied generally to the Company's short-term financial performance, while equity-based compensation is directed towards the Company's successful results over a longer period. The purpose of the combination of salary, annual cash awards, and equity awards is to provide the appropriate level of total annual cash compensation and long-term incentives, combined with an appropriate performance-based component. The Committee places the greatest emphasis on performance-based compensation through annual cash awards and long-term equity-based awards, which together comprise the largest portion of Named Executive Officer compensation. The Committee believes that the Company's executive compensation package, consisting of these components, is comparable to the compensation provided in the market in which the Company competes for executive talent and is critical to accomplishing its recruitment and retention aims.

The Company does not have employment agreements or severance arrangements with any of the Named Executive Officers.Officers and executive officers.

Overview of Compensation Program and Process

The Committee is responsible for reviewing and approving the base salaries, annual performance-based cash awards, and long-term incentive compensation for the Company's Named Executive Officers.

Management assists the Committee in fulfilling its responsibilities with respect to evaluating executive performance, proposing appropriate performance targets for the annual and long-term incentive plans and developing recommendations as to appropriate salary levels and award amounts. For 2014,2015, the Company's Chief Executive Officer, Mr. Stone, provided to the Committee his recommendations with respect to potential compensation of the other Named Executive Officers. The Committee reviewed and gave considerable weight to these recommendations because of Mr. Stone's

direct knowledge of the other executives' performance and contributions. With respect to those officers, the Committee ultimately used its collective judgment to determine the compensation levels, including base salaries, annual performance-based cash awards and long-term equity award grants. Mr. Stone recommended that his compensation levels be identical to those of the Company's President, Mr. Kaplan, due to the current and historical level of work and responsibilities shared by them. The

Committee ultimately determined and approved Mr. Stone's compensation independently based on its collective judgment, and accepted his recommendation to compensate Mr. Kaplan in the same manner.

Role of Compensation Consultant

As part of its process, the Committee utilized the assistance of Frederic W. Cook & Co., an executive compensation consulting company ("Cook"), to assist in evaluating executive compensation programs and in evaluating Named Executive Officers' compensation compared to an established peer group of similar companies. Cook was engaged by and communicated directly with the Committee. In determining compensation for 2014,2015, the Committee considered a market analysis prepared by Cook in early 20142015 which compared our compensation program to a variety of third-party industry compensation surveys and a peer group of 1718 companies. The companies included in the peer group are set forth in this Compensation Discussion and Analysis under the heading "Benchmarking."

Other than as described herein, Cook did not provide any other services to the Company or the Committee in 2014.2015. The Committee has considered the independence of Cook in light of SEC rules and NYSE listing standards. In connection with this process, the Committee has reviewed, among other items, a letter from Cook addressing the independence of Cook and the members of the consulting team serving the Committee, including the following factors: (i) other services provided to us by Cook, (ii) fees paid by us as a percentage of Cook's total revenue, (iii) policies or procedures of Cook that are designed to prevent conflicts of interest, (iv) any business or personal relationships between the senior advisor of the consulting team with a member of the Committee, (v) any Company stock owned by the senior advisor or any immediate family member, and (vi) any business or personal relationships between our executive officers and the senior advisor. The Committee discussed these considerations and concluded that the work performed by Cook and its senior advisor involved in the engagement did not raise any conflict of interest.

At the 20142015 Annual Meeting of Stockholders, the Company's stockholders approved, on a non-binding advisory basis, the overall compensation of the Company's Named Executive Officers as presented in the Proxy Statement for that meeting, with approximately 97%98% of the votes cast in favor. Given the high level of stockholder support, the Compensation Committee did not make any changes to the Company's executive compensation philosophy, principles, and elements in response to the vote.

The Committee reviews survey information of executive compensation payable by a designated peer group, both with respect to target and actual compensation data available. The purpose of this review is to evaluate whether the Company's total executive compensation levels (including base salaries, annual cash awards, and equity awards) is viewed by the Committee to be reasonable, competitive, and appropriate. One of the Company's objectives is to deliver compensation within the median market range. The Company considers compensation to be within median market range with respect to salary if it is within 10% of the median, with respect to bonus if it is within 15% of the median, and with respect to long term incentive and total compensation if it is within 20% of the median. The Committee considers executive compensation paid at the peer companies when setting executive compensation levels at the Company, but the Committee does not attempt to maintain a specified target percentile within this peer group to determine executive compensation. In light of the

request by Mr. Stone that he and Mr. Kaplan receive the same level of compensation, the Committee compares the aggregate compensation for Messrs. Stone and Kaplan against the aggregate compensation for the chief executive officers and chief operating officers of the peer group companies.

The peer group of companies is comprised of firms that are similar to the Company in terms of business lines, market conditions, and size. The Committee expects to reevaluate from time to time the composition of the designated peer group as the Company executes its strategy of organic and strategic growth. For 2014,In 2015, the Committee added Bemis Company,Resolute Forest Products, Inc., Boise Cascade LLC, Domtar

Corporation, and Sonoco Product Company and removed Boise, Inc., Buckeye Technologies, Verso Paper Corp., and Wausau Paper Corporation to its peer group as a part of this exercise. These additions and removals were intended to reflect recent industry mergers as well as KapStone's significant growth in 2013. The comparison group of seventeeneighteen companies has a median revenue of approximately $3.1$3.7 billion.

| Bemis Company, Inc. | Myers Industries, Inc. | |

| Boise Cascade LLC | Neenah Paper, Inc. | |

| Clearwater Paper Corp. | Norbord Inc. | |

| Domtar Corporation | Packaging Corporation of America | |

| P.H. Glatfelter Company | Rock-Tenn Company | |

| Graphic Packaging Holding Company | ||

| Greif, Inc. | ||

| Louisiana-Pacific Corporation | ||

| Mercer International Inc. | Sonoco Products Company |

Components of Executive Compensation

The following provides an analysis of each element of compensation, what each is designed to reward, and why the Committee chose to include it as an element of the Company's executive compensationcompensation.

Base salaries are reviewed annually in the context of the Committee's consideration of the effect of base compensation on recruiting and retaining executive talent. Accordingly, the Committee considers the executive compensation of the peer group. In establishing each Named Executive Officer's base salary, the Committee considers several factors, including individual job performance, salary history, competitive external market conditions for recruiting and retaining executive talent, the scope of the executive's position and level of experience and changes in responsibilities.